In May 2016, the Federal Reserve Board published its “Report on the Economic Well-Being of U.S. Households in 2015.” This report, based on a survey of thousands of adults nationwide, captures Americans’ perspectives, behaviors and concerns as related to their financial situation.

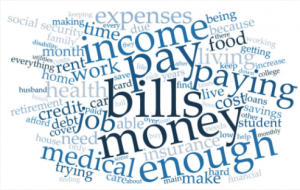

As part of the survey, all respondents were asked if they faced any financial challenges, and over half said that they did. These respondents were then asked: “In a couple of words (150 character max), please describe the main financial challenges or concerns facing you or your family?” Their open-ended answers are presented in the form of a word cloud. A word cloud is a visual representation of text in which words or themes that are repeated more often in the text appear in bigger, bolder print.

Here are the word clouds displaying the answers to this question for respondents who had a family income of less than $40,000 (on the top) and for those with a family income of more than $100,000 (on the bottom).

Look at the most prominent words in the word cloud of the lower-income respondents: income, pay and paying, bills, money, and enough. For these people, concern about immediate or short-term financial demands took center stage. They thought heavily about bills, the constant month-to-month obligations that are no sooner met than they come up again the next month. They were aware that a single lapse in monthly income, or an unexpected expense that left them without enough money to cover their bills, threatened to put them further behind and make the following month still more difficult to face.

Meanwhile, those with higher incomes were most preoccupied with challenges relating to retirement—an issue that is certainly important, especially for older adults, but often not as urgent. Many of us even have trouble picturing our own retirement in detailed, concrete terms. Evidently, a higher income afforded these respondents more breathing room to consider not just the needs of the moment but those of the long-term, indefinite future.

Other key words that these higher-income respondents used more often than their lower-income counterparts in expressing their financial concerns included college, saving, credit, debt, and children. The overall picture suggests that these more affluent people were able to step back, take stock of their overall economic position, and plan strategically for their own future economic well-being and that of their offspring. While the lower-income respondents doubtless had comparable long-term needs, and could benefit from similar planning and strategizing to address them, their ongoing obligation to meet life’s concrete, daily demands did not always allow them the luxury of a wider vision.

The lesson of these word clouds is that poverty represents more than a snapshot of a person’s current financial resources. Living with low income affects a person’s state of mind, day-to-day priorities, and outlook on life: the burden of constant concern about basic needs limits the mental energy one has available to devote to strategies for building a more secure future. To make sure everyone has a realistic chance of attaining economic self-sufficiency, we as a society must look for systemic solutions that help people gain and maintain control of their short-term well-being.

The entire report is available here.